|

ComPair Data launches

BlueWater Reporting Application Server

ComPair Data has vastly expanded the range of tools available to its

users

with the launch of a new application server,

BlueWater Reporting.

The new tools include, most notably, the ability to instantly

generate online reports in HTML format, enabling subscribers to quickly

access capacity levels on virtually every global trade lane.

The data can still be downloaded into spreadsheet form, but the new

upgrade allows for critical industry information to be viewable in a

broader range of formats

and on mobile devices.

Aside from improvements from an ease of use perspective, the new

system also houses a host of new functionalities, including:

-

Vessel Deployment Report:

Provides the ability to compare a shipping line’s vessel deployment

patterns on specific trades at regular intervals over the past three

years. This new function can also be used to compare different

lines’ deployment patterns on various trades against one another. As

an example, a user could see how APL’s vessel deployment on the

Asia-to-Oceania trade has varied monthly over the last three years,

and then compare that to one of APL’s alliance partners, or to

another lines outside its alliance.

-

Trade Route Splits Report:

Gives a breakdown of a line’s allocated capacity by trade route on a

specific date. Users can see which trades are most important to a

specific line by seeing what percentage of its global allocated

capacity is dedicated to certain routes. For instance, as of Feb. 5,

56 percent of the weekly allocated capacity provided by Hanjin

Shipping on vessels it operates was tied to the transpacific trade

(including 46 percent on the Asia-North America West Coast two-way

trade).

-

Transit Analysis Report:

Allows a user to quickly view the characteristics of all of the

services provided by all carriers between two ports, most

importantly the advertised transit times of the various services.

So, for example, a user to could see how many services connect

Ningbo and Oakland, which carriers or alliances are operating those

services, and then compare the transit times between the two ports

among the services offered. The report also includes direct links to

the carriers’ schedules for the corresponding services. In this

example, ComPair Data shows four services linking those two ports,

as of Feb. 5, with transit times ranging from 15 days on China

Shipping’s AAC service to 22 days on the Grand Alliance’s CCX

service.

Reports from the new system can be generated on an alliance-wide or

single operator-only basis, or users can select their own subset of

carriers to compare. Previous functionalities, including the core

reports on deployed vessel capacity and allocated capacity by trade

lane, are still available as well

|

|

Schedule Integration

In addition to

providing detailed data for analysis of liner shipping, ComPair

Data also gathers detailed vessel voyage schedule information on

liner services on a global basis.

ComPair takes a

unique approach in gathering schedule data. When

we launch a trade route, we cover 100% of the liner services

available on that trade route.

Schedules are

provided in a data format designed to be easily integrated with contract and allocation data enabling

companies to more

effectively manage and control the procurement of ocean carriers

services.

Click here to

request a demonstration. |

|

|

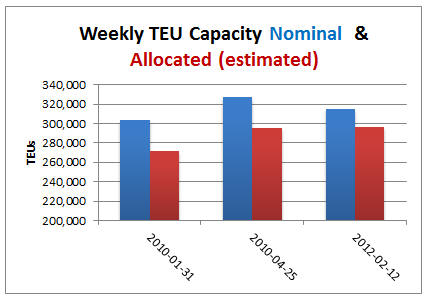

Data Snapshot- February 12, 2012

Capacity in Eastbound Transpacific nears that

of May 2010

While transpacific carriers stripped a significant amount of

capacity out of the eastbound trade in the last three quarters

of 2011, they’ve held capacity levels stable since the start of

December.

On Dec. 4, carriers were allocating an estimated 295,655 TEUs of

weekly capacity. On Feb. 12, weekly capacity had risen

marginally to 296,177 TEUs (an increase of 0.1 percent).

Nominal capacity on the trade has hardly wavered in the last 10

weeks either, moving in a band of 314,812 TEUs (the Feb. 12

level) and 319,793 TEUs (on Jan. 1). On Dec. 4, it was 314,880

TEUs, virtually the same level on February 12 .

Looking back to 2010 when rates rose significantly, allocated

capacity is roughly 9 percent higher today than it was in early

February 2010 (272,157 TEUs), when carriers had pulled sizable

swathes of services in an attempt to better balance supply and

demand on global east-west trades. However, on February 12 it

was at virtually the same level as it was at the beginning of

May 2010, at the end of transpacific service contract

negotiations that year.

|

|